Financial wellbeing from MUNNY and HA | Wisdom Wellbeing

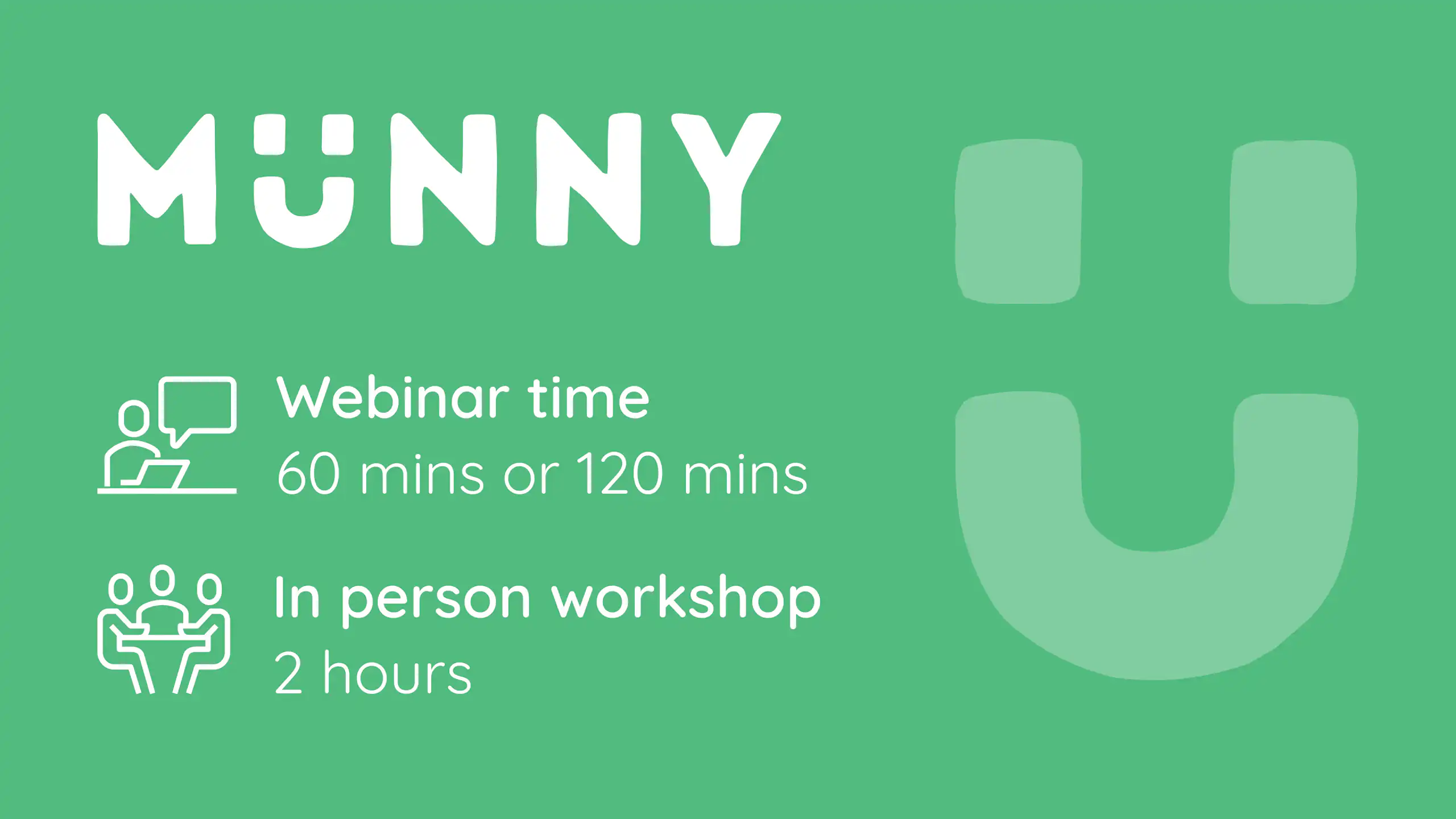

1:1 Coaching, Workshops and Webinars

Stagnating wages, increased housing costs, inflation – you and your people’s wellbeing may well be impacted. Lessen this impact through financial wellbeing, education and empowerment through our support

1:1 Financial Coaching

With our 1:1 Coaching service, individuals can access personalised financial guidance to help unlock their financial potential. The service gives your people the chance to engage in an informal 1:1 conversation with one of our experienced Munny coaches.

These private and confidential sessions give individuals the space to openly discuss their financial circumstances, goals, and challenges surrounding things like debt, budgeting, pensions and much more. The conversations are tailored to each individual, leading to transformative results.

Financial Empowerment & Wellbeing

Our financial empowerment and wellbeing webinar gives a great introduction to each of our core areas of focus. Providing simple jargon & myth busting advice, hints and tips to help any individual navigate their financial decisions better informed. The webinar covers; earning, saving, spending, borrowing, credit reports, pensions, investments, insurance and debt advice & debt management solutions.

Household Budgeting

In this comprehensive webinar, we will focus on three key aspects of financial management: earning, saving, and spending. We understand the challenges faced by individuals who are starting out financially, as well as the unique considerations of parents and families.

Through interactive discussions and expert guidance, we aim to equip you with the knowledge and skills to successfully navigate your household budget.

Credit and Borrowing

Join us for an insightful and comprehensive webinar that explores the world of credit, loans, mortgages, and the property buying process. Designed to cater to individuals starting out financially or those preparing to embark on the property ladder, this webinar provides valuable guidance on improving your credit rating, understanding borrowing options, and navigating the complexities of purchasing a property.

Insurance and Protection

Join us for an enlightening webinar that demystifies the complexities of insurance and empowers you to make informed decisions when it comes to protecting yourself, your family, and your belongings. Designed to cater to individuals starting out financially, as well as parents and families, this webinar aims to bust the myths and jargon surrounding insurance, boosting attendees’ confidence when shopping for coverage.

Financial Future

In this dynamic webinar, we will dive into the world of pensions, investments, and mapping out your financial future. Our expert speakers will guide attendees through the intricacies of pension schemes, investment vehicles, and retirement planning strategies. We will help you calculate the amount you’ll need to retire comfortably and provide actionable steps to achieve your financial goals.

Whether you’re just starting out financially or seeking to strengthen your investment knowledge, this webinar will equip you with the tools and understanding to make informed decisions.

Debt Solutions

In this thought-provoking webinar, we will delve into the multifaceted aspects of struggling with money, unraveling its causes, understanding its effects, and identifying effective solutions. Our experienced presenters will shed light on common financial challenges faced by individuals and families, and provide valuable insights on how to navigate through them.

Through candid discussions and real-life examples, we will explore preventative measures to avoid falling into the debt trap, as well as actionable solutions for those already burdened by financial challenges.

Cost of Living Crisis

This webinar helps attendees to understand the reason our world is getting more expensive. We discuss all of the factors behind the current cost of living crisis and enable individuals to have informed conversations about the economy. Particularly useful for those starting out financially, parents, families and those keen to deepen their understanding of the UK economy.

Cyber Safe

This webinar focuses on practical tips to keep your money and identity safe online. Attendee’s will leave the room being able to keep their family safe from online scams and attacks. Particularly useful for those starting out financially, parents, families and those keen to improve their online skills.

This webinar welcomes participants from all backgrounds, irrespective of their level of online expertise. Whether you’re a beginner or have some experience with online safety, our experts will provide valuable insights suitable for individuals seeking to keep their money and identity safe in the digital realm.

Let's discuss your requirements

To join us on our mission to financially empower the nation by improving financial literacy, boosting number confidence, and paving the way for financial success. Together, we can make a lasting impact on the financial wellbeing of your organization and your people. Together, we can build a brighter future. Contact us for more information

Why does my business need access to financial wellbeing?

The hidden cost of financial stress

Training Programs

Benefits to your People

1:1 Coaching With Munny

Frequently asked questions

Start supporting your people financially today

By investing in the financial wellbeing of your employees, members or students - you contribute to a stronger, more resilient workforce and community.

Our services equip individuals with the knowledge, tools, and confidence needed to make sound financial decisions, fostering a culture of empowerment and responsible money management.